As to gold the following is some information passed along by friend and subscriber David Hurwitz.

Today's COT report on gold compared to the priors since March 5th now reveals a new low level of bearishness by Commercials and a new low level of bullishness by Speculators, as shown below:

A tthe ETF Digest we’ve raised cash to high levels (50%) and what long positions we have in equities are even more modest with most in dividend related issues and even some fixed income.

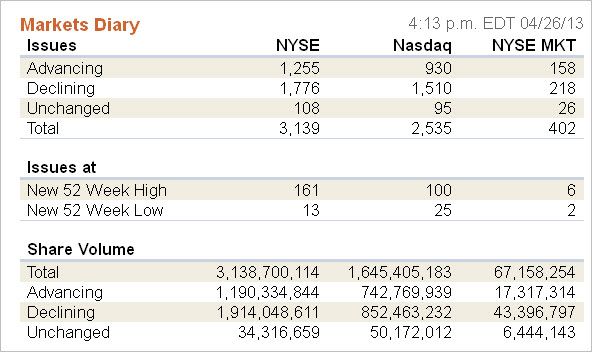

Volumewas once again ultra-light as traders may have left for the weekend at the Hamptons. Breadth per the WSJ was negative overall.

You can follow our pithy comments on twitter and become a fan of ETF Digest on facebook.

Most earnings reports have been mixed overall this week. Some companies have beaten much lowered estimates while others either missed or reported in-line results. Home builder D.R. Horton (DHI) results were stronger lifting homebuilder sector (ITB) while disappointments were reflected in Altera (ALTR) and Amazon (AMZN) which held back tech (QQQ).

Economic data remains weak as GDP Data missed (2.5% vs 3.2% expected & prior .4%). Most of the gains were in consumer spending (primarily higher gas prices, student loans and auto lending with the latter expanding bubbles) while most disappointments were in inventory and fixed investments. Consumer Sentiment fell to a three month low (76.4 vs 78.6).

Richard Davis, Founder & CEO of Consumer Metrics, provides great insight into both consumer spending and the GDP report at this link.

Still the week overall was quite positive for stocks overall particularly in developed markets where QE/ZIRP monetary policies are ubiquitous. Those markets are in the U.S., UK, ECB and BOJ to name a few. Friday the Fed tossed another $3.4 billion log on the fire which is what keeps stock bulls happy. This allowed most major market indexes to reverse the 2% drop the previous week with 2% gains.

Current Fed policies has seen calls from three Fed presidents advocating more in the future, including the controversial endorsement from previously discredited Henry Blodgett that Krugman had won the QE debate.

(America, the land of second chances!)

Bulls are still in charge of markets despite the shallow 3% correction the previous week. The conundrum for most investors remains, where else to put your money despite obvious risks and deceptive conditions? Europe is in recession but that doesn’t seem to bother stock bulls as long as the ECB and BOE will continue to bail them out over the short-term. Japan and the BOJ are “all-in” on QE and other stimulus including trashing their currency with the quiet acquiescence of the G-20. China is presumed to be tightening measures against real estate speculation, and in that regard, their equity markets are declining. (They’re not playing ball.)

As indicated U.S. stocks were up on the week although Friday offered a mixed picture. With disappointments in Consumer Sentiment those sectors fell (XLY) and (XRT). The major indexes were mostly slightly weaker to unchanged including (SPY), (DIA), (QQQ) while small caps (IWM) lagged. Financials (XLF) and materials (XLB) saw profit-taking along with previously popular defensive sectors (XLV), (XLP) and (IYR). Emerging markets (EEM) were weak as was Latin America (ILF) and India (EPI) and China (GXC).

The dollar (UUP) was weak Friday as the yen (FXY) rallied against it. Gold (GLD) was higher early then dropped like a rock once European markets closed. Miners (GDX) were also weak once again. Commodity markets (DBC) fell overall along with energy (USO), base metals (DBB) and agriculture (DBA).

As to gold the following is some information passed along by friend and subscriber David Hurwitz.

/* Style Definitions */ table.MsoNormalTable {mso-style-name:"Table Normal"; mso-tstyle-rowband-size:0; mso-tstyle-colband-size:0; mso-style-noshow:yes; mso-style-priority:99; mso-style-qformat:yes; mso-style-parent:""; mso-padding-alt:0in 5.4pt 0in 5.4pt; mso-para-margin:0in; mso-para-margin-bottom:.0001pt; mso-pagination:widow-orphan; font-size:11.0pt; font-family:"Calibri","sans-serif"; mso-ascii-font-family:Calibri; mso-ascii-theme-font:minor-latin; mso-fareast-font-family:"Times New Roman"; mso-fareast-theme-font:minor-fareast; mso-hansi-font-family:Calibri; mso-hansi-theme-font:minor-latin; mso-bidi-font-family:"Times New Roman"; mso-bidi-theme-font:minor-bidi;}

...

We head toward the final trading days of April next week Wednesday. We’ll get more earnings reports and then the employment report on Friday.

The light volume melt-ups continue as distribution builds on selling. Corporate balance sheets are in good shape thanks to the Fed. But overall hiring with good paying jobs isn’t available yet and may not come for a long period. There is plenty of corporate cash overseas and that’s where it’s staying. In fact, Apple, with its large cash hoard, is keeping that overseas thanks to dumb U.S. corporate tax policies. The company will buyback more shares with borrowed funds and prevailing low interest rates. That’s just another negative effect of administration and Fed policies. There are more but I hope you have a great weekend.

Let’s see what happens.