California home prices experienced a big surge in 2012. This might fly in the face of stagnant household incomes but the incredible push for lower interest rates and reliance on low down payment FHA insured loans has brought many people off the fence. In Southern California home sales are up by 14 percent over the last year and the median price is now up by 16 percent. The median price is largely being pushed by the mix of home sales. Distressed properties are making up a smaller pool of sales. With low inventory, you have regular home buyers competing also with house flippers, big Wall Street buyers, and foreign money with limited supply on the market. The result has been to push home prices much higher making it more difficult for middle class families to afford a home. As we approach the end of 2012, let us look at the data for Southern California.

Southern California home sales and prices

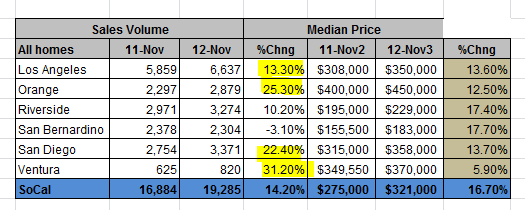

The trend for higher sales and higher prices continued throughout the year:

Of the above home sales, 33 percent were all cash buyers. Cash buyers paid a median $263,000 for purchased homes, and this is up a stunning 27 percent from last year showing the massive pressure being brought on by low inventory. Of course all cash buyers are largely investors and they are consuming a third of the market.

Next you have about 16 percent of homes being purchased with FHA insured loans. This is down from 21 percent last year and about a third from two years ago. FHA loans are now becoming much more expensive products to take on with higher insurance premiums courtesy of massive defaults in the overall portfolio.

Jumbo loans are now back in fashion. 21 percent of sales last month were financed by these kind of loans (above $417,000). Short sales made up about 25 percent of the market. Activity is picking up but what you see is that investors are paying much less for the properties they buy while those looking for move in ready homes are leveraging up, many with jumbo loans or low down payment products.

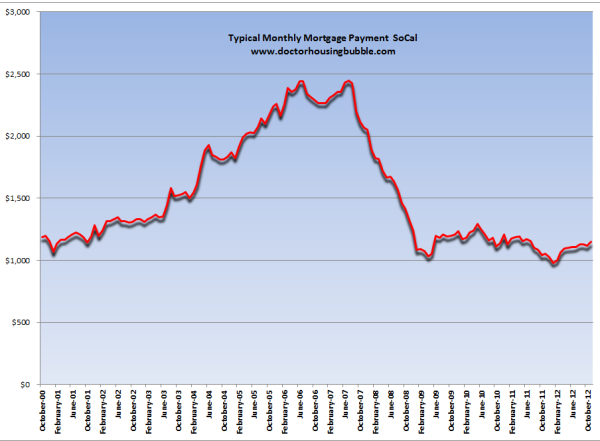

What is a more telling sign is the amount of the monthly nut for home buyers with a mortgage:

While home values are moving up largely because of low interest rates, low inventory, and investors you can see that those financing homes with mortgages still cannot afford higher payments. The amount people are taking on via mortgage payments is still close to half of what it was during the peak. This is a better metric of what local households can truly afford based on their actual income.

Another bubble brewing?

It is hard to believe how quickly prices are rising but when you look below the surface, you realize that this rush is coming via cheap money and hot money from other sources. Many investors looking to buy homes to rent out are now turning away from places like the Inland Empire because the yields are no longer attractive. Flipping can only go on as long as easy financing is in play. Foreign money will only continue so long as our economic growth is in play. The Fed keeping interest rates low has given the market a major boost but how will life be after the boost?

The animal spirits did come out in 2012 at least for housing. Yet the economy is still weak and the young home buyer section of our economy is still in economic shambles. Unlike previous generations this group now approaches the home buying market with over $1 trillion in student loan debt. Many are unable to finance a home in high priced states like California. The figures of the last decade certainly show a large migration out of the state by the middle class.

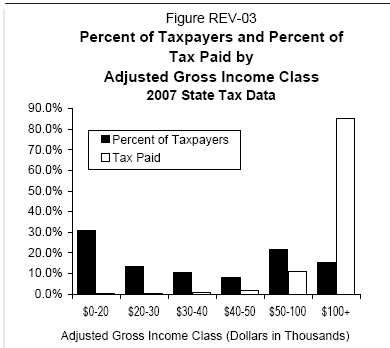

It seems like the economic split in California is only growing deeper. California is very much a boom and bust state. A large portion of revenues come from higher income tax payers, many who depend on the whims of the economy:

With higher taxes coming online and a recent bull stock market, can this continue? Many pay very little to no taxes and as we mentioned, the state is nearly half and half between renters and home owners. A more stable tax basis comes from property taxes and we are already seeing talks about Prop 13. If you take a look at Texas with incredibly high property taxes and strict laws on funky mortgages, they rode out the housing boom and bust with little issues. California going into another boom is easily understood when you compare taxes for example.

Say a home in California sells for $500,000. The taxes paid depending on the county will be about $5,000 to $6,000 per year. In Texas you are looking at annual taxes of roughly $15,000. This keeps a lid on massive price movement because those paying $500,000 can actually afford the larger monthly nut. California’s current rise is a matter of artificially low rates and investment buying. There are also stricter rules on tapping out home equity but it is interesting as a comparison.

The quick counter is that we have coastal regions and many prime locations. Of course. But what about the Inland Empire that is now seeing major price hikes? What is going on there? So something else is happening and it is certainly not coming from higher household incomes.

Is another bubble in California possible? Absolutely. Prices are rising disconnected from household incomes. The only way we keep moving at the current pace is if all of the above groups continue to purchase: investors, flippers, foreign money, FHA loans, low Fed rates. Missing from the equation is household income growth but then again, this is repeating the history of the first bubble run.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.